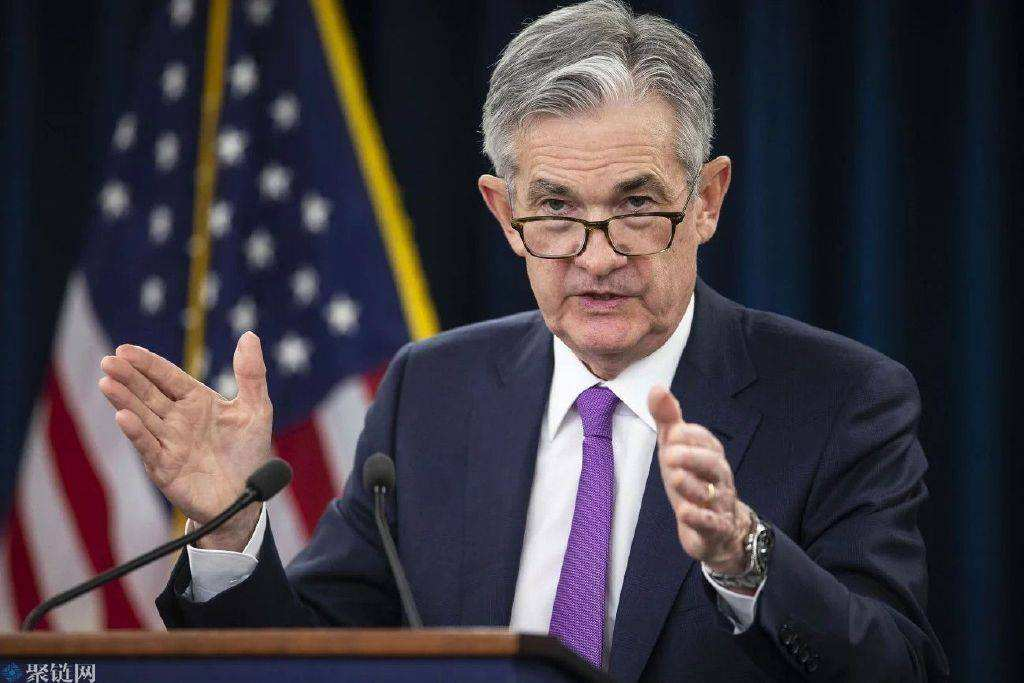

Shugaban bankin Tarayyar Amurka (Fed) Jerome Powell (Jerome Powell) ya halarci zaman da kwamitin kudi na majalisar dattijai ya gudanar jiya (22) da yamma don ba da shaida kan rahoton manufofin hada-hadar kudi na shekara-shekara."Bloomberg" ya ruwaito cewa Powell ya nuna a taron da Fed ya yanke shawarar tada kudaden ruwa isa don ganin hauhawar farashin kaya ya yi sanyi, kuma ya ce a cikin jawabinsa na budewa: Jami'an Fed suna tsammanin ci gaba da haɓaka ƙimar riba zai dace don sauƙaƙe 40 Mafi kyawun farashin farashi. a cikin shekaru.

“Haɗin kai a fili ya tashi ba zato ba tsammani a cikin shekarar da ta gabata, kuma akwai yuwuwar samun ƙarin abubuwan mamaki a nan gaba.Don haka muna buƙatar zama masu sassauƙa tare da bayanai masu shigowa da kuma canjin yanayin.Tafiya na haɓaka ƙimar kuɗi na gaba zai dogara ne akan ko (da kuma yadda sauri) hauhawar farashin kayayyaki ya fara faɗuwa, aikinmu ba zai iya kasawa ba kuma dole ne ya dawo da hauhawar farashin kaya zuwa 2%.Ba a kawar da duk wani hauhawar farashin idan ya zama dole.(100BP hada da)"

Babban bankin tarayya (Fed) ya sanar a ranar 16 ga wata cewa, za ta kara yawan kudin ruwa da yadi 3 a lokaci guda, kuma yawan kudin ruwa ya karu zuwa kashi 1.5% zuwa kashi 1.75%, wanda ya kasance mafi girma tun daga shekarar 1994. Bayan taron, ya bayyana cewa, yawan kudin ruwa ya karu zuwa kashi 1.5% zuwa kashi 1.75 cikin dari. taro na gaba zai fi yiwuwa ya karu da 50 ko 75%.tushe batu.Sai dai ba a yi magana kai tsaye kan girman hauhawar farashin kayayyaki nan gaba ba a zaman na ranar Laraba.

Saukowa mai laushi yana da ƙalubale sosai, koma bayan tattalin arziki mai yiwuwa

Alkawarin Powell ya haifar da fargabar fargabar cewa matakin na iya jefa tattalin arzikin kasar cikin koma bayan tattalin arziki.A taron da ya yi jiya, ya sake nanata ra'ayinsa cewa tattalin arzikin Amurka yana da karfi sosai kuma yana iya yin taka tsan-tsan wajen karfafa kudaden.

Ya bayyana cewa Fed ba yana ƙoƙari ya tayar da hankali ba, kuma ba ya tunanin muna bukatar mu haifar da koma bayan tattalin arziki.Duk da yake bai yi tunanin yiwuwar koma bayan tattalin arziki ba musamman a yanzu, ya yarda cewa tabbas akwai dama, lura da cewa abubuwan da suka faru a baya-bayan nan sun sa ya zama da wahala ga Fed don rage hauhawar farashin kayayyaki yayin da yake ci gaba da samun kasuwa mai karfi.

“Sauka mai laushi shine burinmu kuma zai zama da wahala sosai.Abubuwan da suka faru a cikin 'yan watannin da suka gabata sun sa wannan ya zama mafi ƙalubale, tunani game da yaƙi da farashin kayayyaki da ƙarin batutuwa tare da sarƙoƙi. "

A cewar "Reuters", Fed ya kasance dovish, kuma shugaban bankin tarayya na Chicago Charles Evans (Charles Evans) ya fada a cikin wani jawabi a wannan rana cewa ya dace da ainihin ra'ayin Fed na ci gaba da haɓaka kudaden ruwa da sauri don yaki. hauhawar farashin kayayyaki.Kuma ya nuna cewa akwai kasada da yawa.

"Idan yanayin tattalin arziki ya canza, dole ne mu kasance a faɗake kuma mu kasance cikin shiri don daidaita manufofinmu," in ji shi."Gyara a bangaren samar da kayayyaki na iya zama a hankali fiye da yadda ake tsammani, ko kuma yakin Rasha da Ukraine da kuma kulle-kullen China na COVID-19 na iya rage farashin," in ji shi.Ƙarin matsa lamba.Ina tsammanin ƙarin hauhawar farashin zai zama dole a cikin watanni masu zuwa don dawo da hauhawar farashin kayayyaki zuwa 2% matsakaicin matsakaicin hauhawar farashin farashi.Yawancin mambobin kwamitin da aka kafa na Fed sun yi imanin cewa farashin yana buƙatar tashi zuwa aƙalla 3.25 a ƙarshen shekara % -3.5% kewayon, yana tashi zuwa 3.8% a shekara mai zuwa, ra'ayi na kusan iri ɗaya ne. "

Ya bayyana wa manema labarai bayan taron cewa sai dai idan bayanan hauhawar farashin kayayyaki ya inganta, zai iya tallafawa wani karin girman yadi uku a watan Yuli, yana mai cewa babban fifikon Fed shine sauƙaƙa farashin farashin.

Bugu da kari, a mayar da martani ga ban mamaki volatility a cikin overall cryptocurrency kasuwar a cikin 'yan kwanaki, Powell ya shaida wa Congress cewa Fed jami'an suna a hankali kallon kasuwar cryptocurrency, yayin da ya kara da cewa Fed bai gaske ganin wani babban macroeconomic tasiri ya zuwa yanzu, amma jaddada cewa. sararin cryptocurrency yana buƙatar ingantattun ƙa'idodi.

“Amma ina ganin wannan sabon yanki na sabon yanki yana buƙatar ingantaccen tsarin tsari.A duk inda irin wannan aiki ya faru, ya kamata a samar da tsari iri ɗaya, wanda ba haka lamarin yake ba a yanzu saboda yawancin samfuran kuɗi na dijital ta wasu hanyoyi suna kama da samfuran da ke cikin tsarin banki, ko kasuwannin babban birnin, amma an tsara su daban.Don haka muna bukatar yin hakan.”

Powell ya nuna wa jami'an majalisa cewa rashin daidaituwa na tsari shine ɗayan manyan kalubalen da ke fuskantar masana'antar cryptocurrency a yanzu.Hukumar Tsaro da Musanya ta Amurka (SEC) tana da hurumin kula da tsaro, kuma Hukumar Kasuwancin Kasuwanci ta gaba (SEC) tana da hurumin kan kayayyaki.“Waye yake da iko a kan wannan?Ya kamata Fed ya yi magana game da yadda bankunan da Fed ke sarrafa kadarorin crypto akan takaddun ma'auni.

Game da batun kwanan nan mai zafi na ka'idojin statscoin, Powell ya kwatanta stablecoins zuwa kudaden kasuwancin kuɗi, kuma ya yi imanin cewa har yanzu statscoins ba su da tsarin tsarin da ya dace.Amma ya kuma yaba da hikimar motsi na yawancin membobin Majalisa don ba da shawarar wani sabon tsari don daidaita tsabar kudi da kadarorin dijital.

Bugu da ƙari, bisa ga Coindesk, SEC kwanan nan ya ba da shawarar a cikin umarnin lissafin kuɗi don kamfanonin da aka jera cewa kamfanoni masu kula da masu rike da kadarori na dijital na abokan ciniki suna buƙatar ɗaukar waɗannan kadarorin a matsayin mallakar takardar ma'auni na kamfanin.Powell kuma ya bayyana a taron jiya cewa Fed yana kimanta matsayin SEC akan tsare kadarorin dijital.

Ƙara ƙa'idodin gwamnati kuma abu ne mai kyau ga cryptocurrencies, ƙyale cryptocurrencies su shiga yanayin da ya fi dacewa da lafiya.Zai iya mafi kyawun kare haƙƙoƙi da buƙatun masana'antu na sama da na ƙasa na cryptocurrencies kamarmasu hakar ma'adinaida masu zuba jari na kudin waje.

Lokacin aikawa: Agusta-21-2022