A ranar 24 ga Fabrairu a lokacin Beijing, shugaban kasar Rasha Vladimir Putin a hukumance ya ba da sanarwar cewa zai gudanar da "ayyukan soji" a Donbas, Ukraine.Daga bisani shugaban kasar Ukraine Vladimir Zelensky ya sanar da cewa kasar ta shiga wani yanayi na yaki.

Ya zuwa lokacin latsawa, farashin zinari ya tsaya a $1940, amma bitcoin ya faɗi kusan 9% a cikin sa'o'i 24, yanzu an ruwaito a $ 34891, Nasdaq 100 index gaba ya faɗi kusan 3%, S & P 500 index Futures da Dow Jones index Futures. ya fadi fiye da 2%.

Tare da karuwar rikice-rikice na geopolitical, kasuwannin hada-hadar kudi na duniya sun fara mayar da martani.Farashin zinari ya yi tashin gwauron zabi, hannun jarin Amurka ya ja da baya, kuma bitcoin, wanda ake dauka a matsayin “zinariya na dijital”, ya kasa fita daga wani yanayi mai zaman kansa.

Dangane da bayanan iska, tun farkon 2022, bitcoin ya kasance na ƙarshe a cikin ayyukan manyan kadarorin duniya da kashi 21.98%.A cikin 2021, wanda ya ƙare, bitcoin ya zama na farko a cikin manyan nau'ikan kadarori tare da haɓakar haɓakar 57.8%.

Irin wannan babban bambanci yana da tunani, kuma wannan takarda za ta bincika wani batu mai mahimmanci daga nau'o'in nau'i uku na abin mamaki, ƙarewa da dalili: shin bitcoin tare da darajar kasuwa na yanzu na kimanin dala biliyan 700 har yanzu ana ɗaukarsa a matsayin "amintaccen kadari"?

Tun daga rabin na biyu na shekarar 2021, hankalin kasuwannin babban birnin duniya ya mai da hankali kan saurin karuwar kudin ruwa na Fed.Yanzu haka rikicin da ya barke tsakanin Rasha da Ukraine ya zama wani bakar fata, wanda ke shafar duk wani nau'in kadarorin duniya.

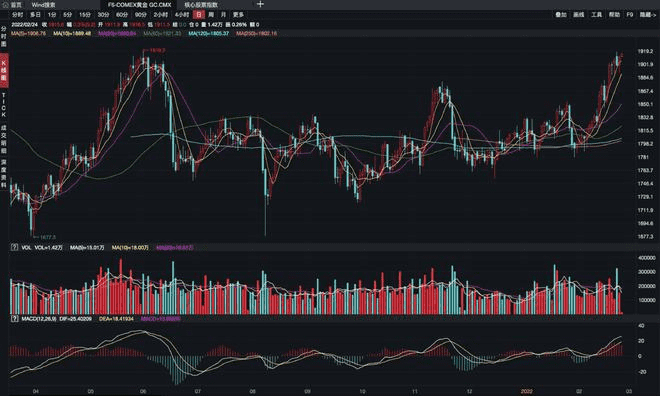

Na farko shine zinare.Tun bayan barkewar rikici tsakanin Rasha da Ukraine a ranar 11 ga Fabrairu, zinari ya zama nau'in kadara mafi ban mamaki a nan gaba.A bude kasuwar Asiya a ranar 21 ga watan Fabrairu, zinari ya yi tsalle cikin kankanin lokaci ya karya dalar Amurka 1900 bayan watanni takwas.Daga shekara zuwa yau, yawan amfanin kuɗin zinariya na Comex ya kai 4.39%.

Ya zuwa yanzu, COMEX zinariya zance yana da inganci na makonni uku a jere.Yawancin cibiyoyin bincike na zuba jari sun yi imanin cewa dalilin da ya sa hakan ya fi girma saboda tsammanin karuwar yawan riba da kuma sakamakon canje-canje a tushen tattalin arziki.A lokaci guda, tare da haɓakar haɓakar haɗari na geopolitical na baya-bayan nan, “ƙiyayyar haɗari” sifa na zinari ya shahara.A karkashin wannan tsammanin, Goldman Sachs yana tsammanin cewa a ƙarshen 2022, hannun jarin ETF zai karu zuwa ton 300 a kowace shekara.A halin yanzu, Goldman Sachs ya yi imanin cewa farashin zinariya zai zama $ 2150 / oce a cikin watanni 12.

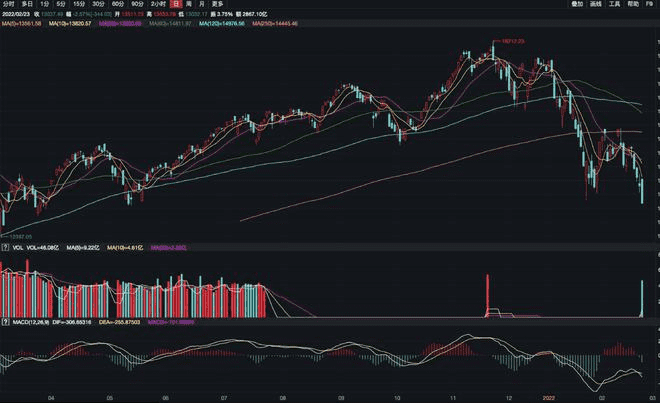

Bari mu kalli NASDAQ.A matsayin ɗaya daga cikin manyan jigogi uku na hannun jarin Amurka, ya kuma haɗa da manyan manyan hannayen jarin fasaha.Ayyukansa a cikin 2022 ba su da kyau.

A ranar 22 ga Nuwamba, 2021, fihirisar NASDAQ ta rufe sama da alamar 16000 a karon farko a tarihinta, inda ta kafa babban rikodi.Tun daga wannan lokacin, alamar NASDAQ ta fara ja da baya sosai.Dangane da rufewa a ranar 23 ga Fabrairu, ma'aunin NASDAQ ya fadi da kashi 2.57% zuwa maki 13037.49, sabon karancin tun watan Mayun bara.Idan aka kwatanta da matakin rikodin da aka saita a watan Nuwamba, ya faɗi da kusan 18.75%.

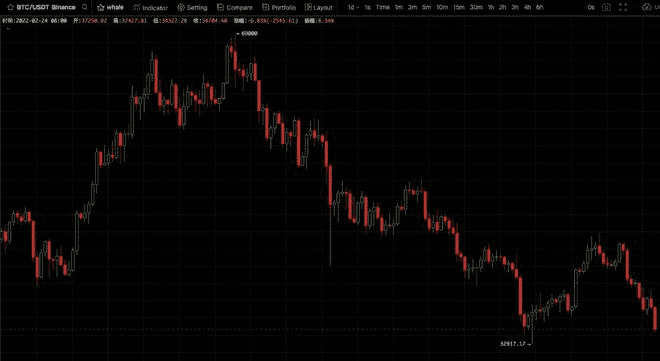

A ƙarshe, bari mu kalli bitcoin.Har zuwa yanzu, sabon zance na bitcoin yana kusa da mu $37000.Tun lokacin da aka saita mafi girman dalar Amurka $69000 a ranar 10 ga Nuwamba, 2021, bitcoin ya ja da baya da fiye da 45%.A yayin faɗuwar faɗuwa a ranar 24 ga Janairu, 2022, bitcoin ya yi ƙasa da mu $32914, sannan ya buɗe kasuwancin gefe.

Tun daga sabuwar shekara, bitcoin a takaice ya dawo da alamar $ 40000 a ranar 16 ga Fabrairu, amma tare da tsanantar rikici tsakanin Rasha da Ukraine, bitcoin ya rufe tsawon makonni uku a jere.Shekara zuwa yau, farashin bitcoin ya faɗi da 21.98%.

Tun lokacin da aka haife shi a cikin 2008 a cikin rikicin kudi, ana kiran bitcoin a hankali "zinariya na dijital" saboda yana da wasu halaye.Na farko, jimillar adadin yana dawwama.Bitcoin yana amfani da fasahar blockchain da kuma ɓoyayyiyar algorithm don sanya adadin sa ya kai miliyan 21.Idan karancin zinare ya fito ne daga ilimin kimiyyar lissafi, karancin bitcoin ya fito ne daga lissafi.

A lokaci guda, idan aka kwatanta da zinariya ta jiki, bitcoin yana da sauƙi don adanawa da ɗauka (ainihin adadin lambobi), har ma ana la'akari da shi ya fi zinariya a wasu bangarori.Kamar yadda a hankali zinare ya zama alamar arziki daga karafa masu daraja tun lokacin da ya shiga cikin al'ummar bil'adama, hauhawar farashin bitcoin ya yi daidai da yadda mutane ke neman arziki, don haka mutane da yawa suna kiransa "zinariya na dijital".

"Kayan kayan tarihi masu wadata, zinare masu wahala."Wannan ita ce fahimtar jama'ar kasar Sin game da alamomin arziki a matakai daban-daban.A farkon rabin shekarar 2019, ya zo daidai da fara yakin cinikin Amurka na Sino.Bitcoin ya fito daga kasuwar beyar kuma ya tashi daga $ 3000 zuwa kusan $ 10000.Halin kasuwa a ƙarƙashin wannan rikici na yanki ya kara yada sunan bitcoin "zinari na dijital".

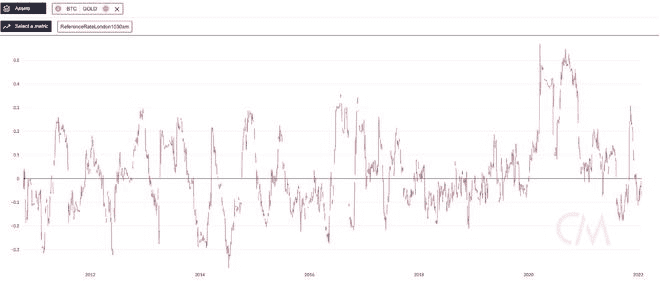

Koyaya, a cikin 'yan shekarun nan, duk da cewa farashin bitcoin yana ƙaruwa da haɓaka sosai, kuma darajar kasuwarsa a hukumance ta zarce dalar Amurka tiriliyan 1 a shekarar 2021, wanda ya kai kashi ɗaya bisa goma na darajar kasuwar zinariya ( ƙididdiga ta nuna cewa jimillar darajar kasuwar zinariyar da aka haƙa. nan da 2021 kusan dalar Amurka tiriliyan 10 ne), alaƙar da ke tsakanin aikinta na farashinsa da aikin gwal ya yi rauni, kuma akwai alamun jan ƙugiya.

Dangane da bayanan ginshiƙi na coinmetrics, yanayin bitcoin da zinare yana da takamaiman haɗin gwiwa a farkon rabin na 2020, kuma alaƙar ta kai 0.56, amma ta 2022, alaƙar da ke tsakanin bitcoin da farashin zinare ya zama mara kyau.

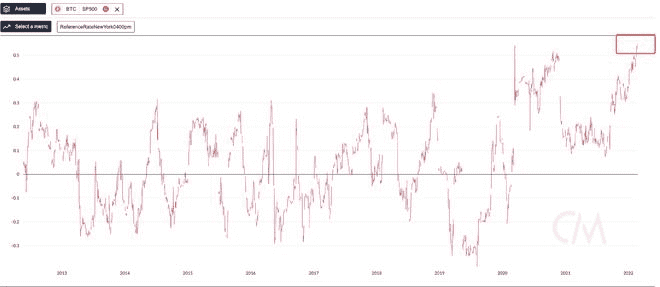

Akasin haka, alaƙar da ke tsakanin bitcoin da lissafin hannun jari na Amurka yana ƙaruwa kuma.

Dangane da bayanan ginshiƙi na coinmetrics, haɗin kai tsakanin bitcoin da S & P 500, ɗaya daga cikin manyan alamomi uku na hannun jari na Amurka, ya kai 0.49, kusa da matsananciyar ƙimar da ta gabata ta 0.54.Mafi girman darajar, mafi ƙarfin haɗin kai tsakanin bitcoin da S & P 500. Wannan ya dace da bayanan Bloomberg.A farkon Fabrairu 2022, bayanan Bloomberg sun nuna cewa alaƙar cryptocurrency da Nasdaq ya kai 0.73.

Daga yanayin yanayin kasuwa, alaƙar da ke tsakanin bitcoin da hannun jari na Amurka kuma yana ƙaruwa.Haɓaka da faɗuwar hannun jari na bitcoin da fasaha na sau da yawa a cikin 'yan watanni uku, har ma daga rugujewar hannayen jarin Amurka a cikin Maris 2020 zuwa faduwar hannayen jarin Amurka a cikin Janairu 2022, kasuwar cryptocurrency ba ta fito daga kasuwa mai zaman kanta ba. amma yana nuna yanayin tasowa da faɗuwa tare da wasu hannayen jari na fasaha.

Ya zuwa yanzu a cikin 2022, shine ainihin jagorar tarin hannun jari na fasaha "faamng" wanda ke kusa da raguwar bitcoin.Tarin manyan kamfanonin fasaha na Amurka guda shida ya ragu da kashi 15.63% a shekara zuwa yau, wanda ke matsayi na karshe a ayyukan manyan kadarorin duniya.

Haɗe da hayaƙin yaƙin, bayan fara yaƙin Ukraine na Rasha a yammacin ranar 24 ga wata, dukiyoyin haɗarin duniya sun faɗi tare, hannayen jari na Amurka da cryptocurrency ba su tsira ba, yayin da farashin zinari da mai ya fara hauhawa, kuma kasuwar hada-hadar kudi ta duniya ta mamaye "hayakin yaki".

Sabili da haka, daga halin da ake ciki na kasuwa na yanzu, bitcoin ya fi kama da kadari mai haɗari fiye da "amintaccen kadari".

An haɗa Bitcoin cikin tsarin kuɗi na yau da kullun

Lokacin da Nakamoto ya tsara bitcoin, matsayinsa ya canza sau da yawa.A cikin 2008, mutum mai ban mamaki mai suna "Nakamoto cong" ya buga takarda da sunan bitcoin, yana gabatar da tsarin biyan kuɗi na lantarki.Daga suna, ana iya ganin cewa matsayinsa na farko shine kudin dijital tare da aikin biyan kuɗi.Koyaya, ya zuwa 2022, kawai El Salvador, ƙaramar ƙasar Amurka ta Tsakiya, a hukumance ta aiwatar da gwajin aikinta na biyan kuɗi.

Baya ga aikin biyan kuɗi, ɗaya daga cikin manyan dalilan da ya sa Nakamoto ya ƙirƙiri bitcoin shine ƙoƙarin gyara halin da ake ciki na buga kuɗi marasa iyaka a cikin tsarin kuɗi na zamani, don haka ya ƙirƙiri bitcoin tare da jimlar adadin kuɗi akai-akai, wanda kuma yana kaiwa ga wani. Matsayin bitcoin a matsayin "anti inflation asset".

A karkashin tasirin annobar duniya a cikin 2020, Tarayyar Tarayya ta zaɓi ceto kasuwa a cikin gaggawa, fara "QE mara iyaka" tare da ba da ƙarin dala tiriliyan 4 a shekara.Manyan kudade na Amurka tare da adadi mai yawa na saka hannun jari a hannun jari da bitcoin.Duk manyan kudade, ciki har da kamfanonin fasaha, cibiyoyin babban kamfani, asusun shinge, bankuna masu zaman kansu har ma da ofisoshin iyali, sun zaɓi "zaɓe da ƙafafunsu", A cikin kasuwar ɓoyewa.

Sakamakon wannan shine hauka hauka a farashin bitcoin.A cikin Fabrairu 2021, Tesla ya sayi bitcoin akan dala biliyan 1.5.Farashin bitcoin ya tashi da fiye da $10000 a rana kuma ya kai farashin dala 65000 a shekarar 2021. Ya zuwa yanzu, wechat, wani kamfani da aka lissafa a Amurka, ya tara fiye da bitcoins 100000 da kuma manyan mukamai masu launin toka fiye da 640000 bitcoins.

A takaice dai, kifin kifin bitcoin, wanda babban babban birnin Wall Street na Amurka ke jagoranta, ya zama babban karfi da ke jagorantar kasuwa, don haka yanayin babban jari ya zama iska na kasuwar boye-boye.

A cikin Afrilu 2021, coinbase, mafi girman musayar boye-boye a Amurka, an jera shi, kuma manyan kudade suna da damar yin biyayya.A ranar 18 ga Oktoba, SEC za ta amince da ProShares don ƙaddamar da Bitcoin Futures ETF.Bayyanar masu saka hannun jari na Amurka ga bitcoin za a sake faɗaɗa kuma kayan aikin za su fi dacewa.

A lokaci guda kuma, Majalisar Dokokin Amurka ta fara gudanar da sauraren ra'ayoyin jama'a game da cryptocurrency, kuma bincike game da halayensa da dabarun tsarawa ya zama mai zurfi da zurfi, kuma bitcoin ya rasa ainihin asirinsa.

A hankali Bitcoin ya kasance cikin gida a matsayin madadin kadari mai haɗari maimakon maye gurbin zinari a cikin aiwatar da ci gaba da damuwa da manyan kudade da kuma karɓar kasuwa ta yau da kullun.

Sabili da haka, tun daga ƙarshen 2021, Tarayyar Tarayya ta haɓaka saurin haɓaka ƙimar riba kuma tana son dakatar da aiwatar da "babban sakin ruwa daga dalar Amurka".Abubuwan da ake samu na haɗin gwiwar Amurka ya karu da sauri, amma hannun jari na Amurka da bitcoin sun shiga kasuwar bear fasaha.

A ƙarshe, halin da ake ciki na farko na yakin Ukraine na Rasha yana nuna halin yanzu mai haɗari kadari na bitcoin.Daga canjin matsayi na bitcoin a cikin 'yan shekarun nan, ba a gane bitcoin a matsayin "amintaccen kadari" ko "zinariya na dijital".

Lokacin aikawa: Maris 14-2022